Life Insurance in and around Anderson

Protection for those you care about

What are you waiting for?

Would you like to create a personalized life quote?

It's Time To Think Life Insurance

State Farm understands your desire to cover your loved ones after you pass away. That's why we offer fantastic Life insurance coverage options and compassionate dependable service to help you pick a policy that fits your needs.

Protection for those you care about

What are you waiting for?

Life Insurance You Can Trust

Service like this is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the worst comes to pass, Ron Haskell is committed to helping process the death benefit with care and consideration. State Farm has you and your loved ones covered.

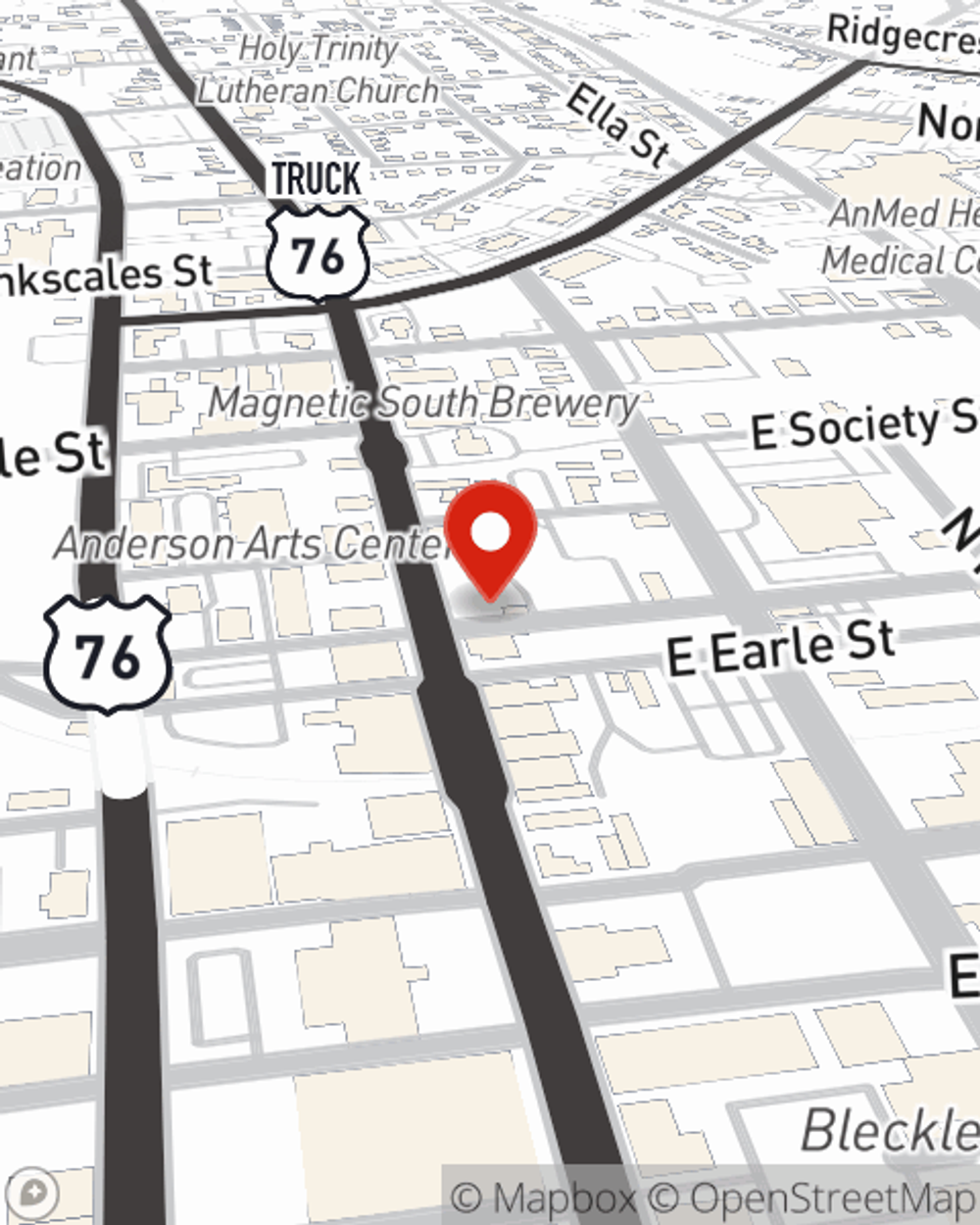

It's always a good time to make sure your loved ones have coverage against the unexpected. Get in touch with Ron Haskell's office to check out your Life insurance policy options.

Have More Questions About Life Insurance?

Call Ron at (864) 226-6043 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Reasons to buy life insurance

Reasons to buy life insurance

Life insurance is often thought of as a way to protect loved ones by providing for final expenses and estate taxes but you can think beyond that.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.

Ron Haskell

State Farm® Insurance AgentSimple Insights®

Reasons to buy life insurance

Reasons to buy life insurance

Life insurance is often thought of as a way to protect loved ones by providing for final expenses and estate taxes but you can think beyond that.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.